Why, in the country of luxury fashion people still pay with paper checks, while more eastward countries use super integrated mobile apps?

In this post, I wanted to share my own experience and compare at a high level the Card Present POS check-out in France, and the solutions used in Russia or China.

France: why change?

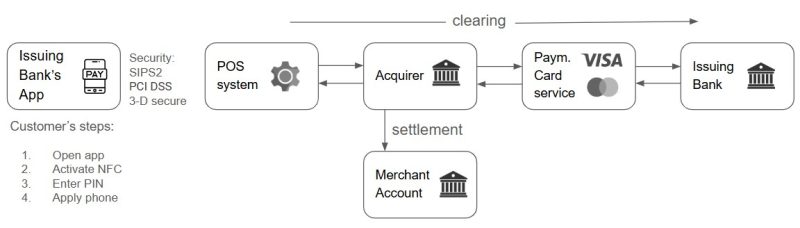

In France, when you pay for a coffee at the bakery the merchant will present you with a basic card terminal. Alternatively, you may be able to use some basic and non user-friendly bank app, working with NFC, where the banking card associated to your account will be used:

The experience overall is frustrating due to the old technology used for the app, often existing only for Android and it works quite slowly.

Also, for mobile person-to-person instant transfers, there is a service called Paylib, but I once used it to transfer money to a cab driver, and the money vanished from my account with him never getting it.

China: private companies took over (for now)

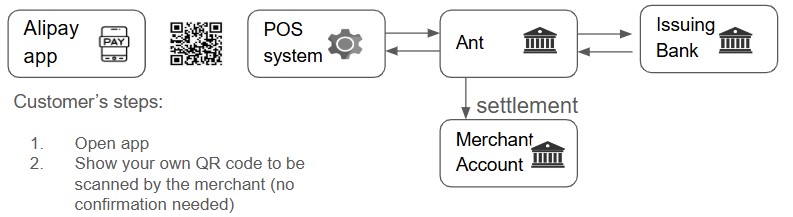

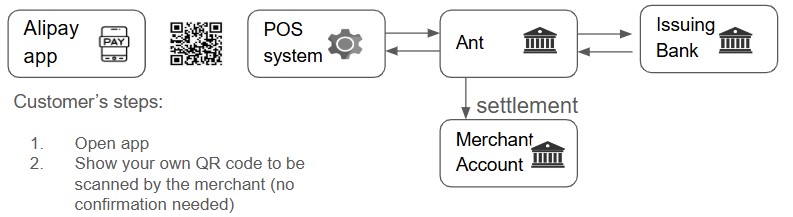

China’s POS check-out practically ditches cash payments and is now dominated almost equally by 2 players: AliPay, from Alibaba’s Ant fintech group, and WeChat Pay, the solution linked to the Chinese social media WeChat and developed by the IT giant Tencent Group.

These tech companies totally transformed the Chinese payment habits, by developing a QR code-based digital wallet system, bypassing traditional card systems that were costly for merchants, especially small businesses. This innovation allowed China to rapidly adopt a more efficient payment method, leading to over a billion users on each platform within a decade. The new system not only replaced cards and cash but also changed social practices, like gift-giving and fundraising.

Both Alipay and Wechat Pay QR codes that can be generated both by the app or by the POS itself. However, for customer ease-of-use the most common form is a dynamic QR-code-to-scan generated by the app:

The experience overall is frustrating due to the old technology used for the app, often existing only for Android and it works quite slowly.

Also, for mobile person-to-person instant transfers, there is a service called Paylib, but I once used it to transfer money to a cab driver, and the money vanished from my account with him never getting it.

China: private companies took over (for now)

China’s POS check-out practically ditches cash payments and is now dominated almost equally by 2 players: AliPay, from Alibaba’s Ant fintech group, and WeChat Pay, the solution linked to the Chinese social media WeChat and developed by the IT giant Tencent Group.

These tech companies totally transformed the Chinese payment habits, by developing a QR code-based digital wallet system, bypassing traditional card systems that were costly for merchants, especially small businesses. This innovation allowed China to rapidly adopt a more efficient payment method, leading to over a billion users on each platform within a decade. The new system not only replaced cards and cash but also changed social practices, like gift-giving and fundraising.

Both Alipay and Wechat Pay QR codes that can be generated both by the app or by the POS itself. However, for customer ease-of-use the most common form is a dynamic QR-code-to-scan generated by the app:

For small businesses or for tips, a static QR-code issued by the merchant can be used to transfer money.

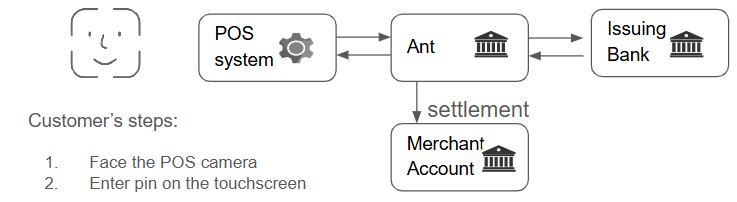

Smile-to-Pay by Alipay is a cardless solution for merchants having a POS equipped with a camera.

So far, everybody is happy with these methods of payment, except the Chinese Central Bank that is poised, after cracking down on bitcoin mining in 2021, to develop its own digital currency and payment solution.

Russia: The Central Bank leads innovation.

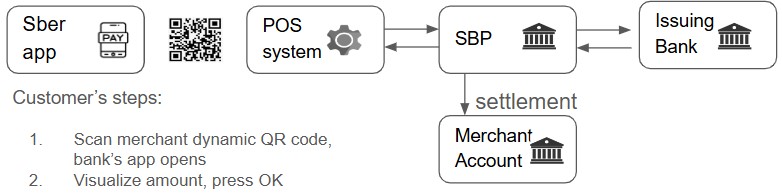

In Russia, for once, a governmental structure created a good fintech product: The Faster Payments System (SBP) is a service that allows individuals to make instant interbank transfers using a mobile phone or a card number and businesses to allow payment using QR-codes. Transfer fees are either very low or zero.

What is the advantage of SBP compared to Alipay? SBP is a secured platform backed by a central authority, and is working to connect as many operators as possible, including Russian fintech companies so they can develop new features and services around SBP. Compare it to an ecosystem with a huge app store, where innovation can thrive around payments. The official SBP website gives precise documentation for developers on SBP OpenAPI calls.

The use cases using SBP for payment are numerous. You can pay your taxes, your fines, your utility bills, or give back a debt to a friend by receiving a link. Two Russian banks / fintech companies, Sber and T-Bank, lead the path to integrate SBP for any daily need via their complex mobile apps.

Let’s see the most common case using SBP in Russia for card-present POS check-out:

In conclusion, enabling applications to easily connect to a centralized payment system through public APIs and a wide range of SDKs fosters innovation and makes the checkout experience smoother than ever. A broader selection of secure payment systems would benefit everyone in France, yet as long as traditional methods continue to function well and primarily profit banks and card service providers, there seems to be little drive for change. Hopefully, payment systems in France will evolve to match the convenience of their Eastern counterparts.